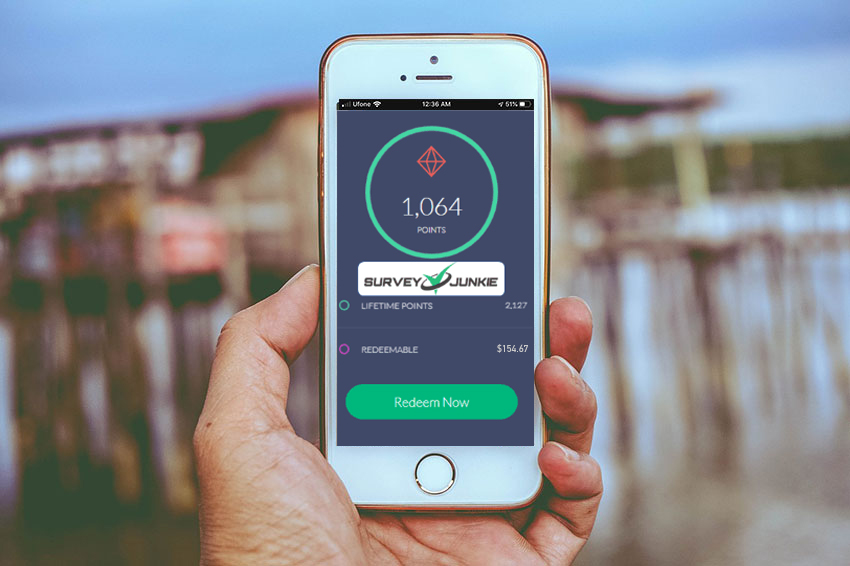

1. Get Paid To Take Online Surveys - This Really Does Work!

Let’s face it, a lot of us now have a bit of extra time on our hands that we just spend binge watching the office on Netflix. What if you could get paid a little bit of extra pocket money just for taking a few online surveys? Would you do it? There’s a new website called Survey Junkie that allows you to do just that. You provide them with a bit of information about yourself and they’ll match you up with surveys that you can complete for big brands. You then earn rewards and virtual points that you can redeem for money in Paypal or e-Giftcards. You won’t make a ton of money doing this, but it could help pay for a few things every month and it’s easy to do. The more surveys you complete the more you get paid.

2. Do Gigs On Fiverr

No matter what type of service you offer, you can likely offer it on Fiverr. This is terrific for digital services such as graphic design, web design, short audio or video clip creation, editing services, writing and so on. If you have a bit of extra time and have decent command of the English language – you can make some good extra cash just from writing a few articles.

Fiverr has expanded beyond just the $5-per-gig model. That means you can get paid much much more than just $5 for tasks you complete. Depending on your skills, you could do considerably well on here. There are even some people making six figures on fiverr.

3. Get a Lower Auto Insurance Rate – Pay Less Than $42/Month

Did you know you can get a lower auto insurance rate if you work from home? You can either ask your current insurer to give you a lower rate or you can use a website to compare quotes from multiple insurers - and let them compete for your business. I mean, you wouldn't consider booking a hotel or vacation without using a price comparison website like Expedia so why aren't you doing the same with your car insurance.

There's a new website that does just that called Provide Insurance. Once you fill out the form on their website they’ll provide you with multiple quotes you can choose from. You are NEVER locked in with your current insurer, so if you have no accidents or tickets in the past two years you should definitely do this.

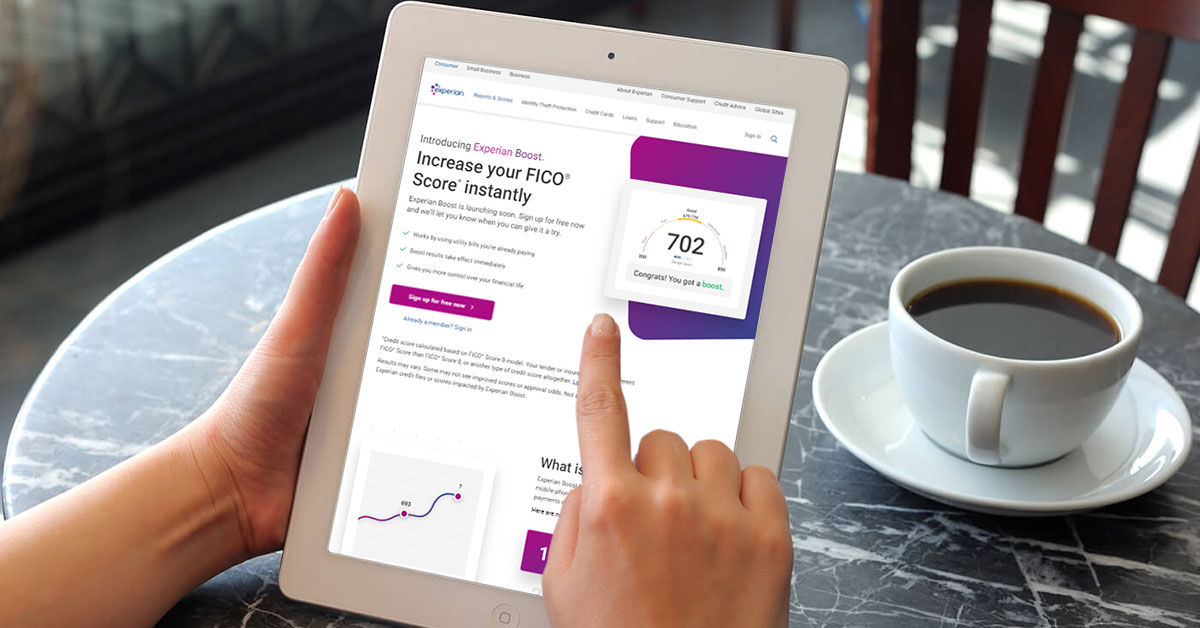

4. Use This Method To Boost Your Credit Score

Let's face it, we all know that a good credit score can open a lot of financial doors while also giving us lower rates of interest on our loans. Credit scores typically range from 300 to 850, with a credit score of 700 or above generally considered good. On that same range, a score of 800 or above is considered excellent. If you already know that your credit score is 800 and above then you probably don't need to keep reading this. In addition to the usual strategies of paying your bills on time, keeping credit card balances low and not applying for too much credit, there's also another way you can quickly increase your FICO score with Experian Boost. Experian® developed a revolutionary service to give consumers a way to quickly increase their credit scores using their on-time utility and telecom bill payments. The process is ridiculously simple and 100% free. You don't need anything to qualify—simply click here to visit their website and sign up to start boosting your score.

5. Become A DoorDash Delivery Driver

Now obviously this isn't the best time to be out of the house, especially if you're older than 50, but people are still ordering food and they need someone to deliver it. DoorDash is still looking for new drivers and it's a great way to make extra money during this lockdown.

We recommend DoorDash as it is one of the top delivery apps out there. Drivers expressed they enjoy the flexibility the service provides, allowing them to make money around their own schedule when they want. The app also allow users to tip on top of their order, meaning more cash for you. Starting is easy too: just sign up, have a valid driver’s license and start earning.

6. Negotiate A Better Mortgage Rate With Government Programs

You may or may not know this but the Federal Reserve just slashed interest rates all the way to 0%, that means these savings are about to be passed onto homeowners.

If you’re a homeowner and you want to save yourself thousands of dollars year after year, there’s government programs you can now take advantage of. These programs could help hundreds of thousands of Americans reduce their monthly payments by as much as $3,252 in their first year. Many of these programs were set to expire in 2020 but with the recent pandemic they are being extended. In order to qualify for these savings you’ll need good or excellent credit. To check if you qualify visit Enhanced Relief, and fill out the short quiz (take 2 minutes). If lowering your payments, paying off your mortgage faster, and having an extra $271 a month in savings would help you, then this could be the easiest money savings tip you take.

7. Claim Free Everyday Household Products

Here’s a little tip most Americans aren’t told about. Chances are you purchase the same household products on a daily/weekly basis. But what if you could get free samples sent to you from these very same manufacturers? Not a lot of people know about it, but you can actually claim free samples from top brands. If you’re looking for a way to get household goods, pet food samples, sweet treats, posters, days out vouchers and much more, we recommend signing up for the Free Samples Guide. Once you provide them with your email address, they’ll let you know when you’re eligible for the latest free samples and how to claim them.

8. Breakthrough Technology Powers Entire Home - Slash Power Bills By 65%

This might be the cheapest, easiest way to effortlessly make your own "personal power plant"... and have a perpetual source of cheap green electricity for anything that might come your way.

You don’t have to be an electrician to do it, there’s no maintenance needed, it doesn’t take up a lot of space and the best part: you won’t need to rely on the power grid anymore. Click Here to see what this Disaster-Proof, Recession-Proof, Drought-Proof "Backyard Power Plant" can do for you.

9. Consolidate All Your Existing Debt Into One Simple Payment

Trying to save money can be pretty daunting. Doing it with existing unsecured debts can make it even more of a challenge. Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $10,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

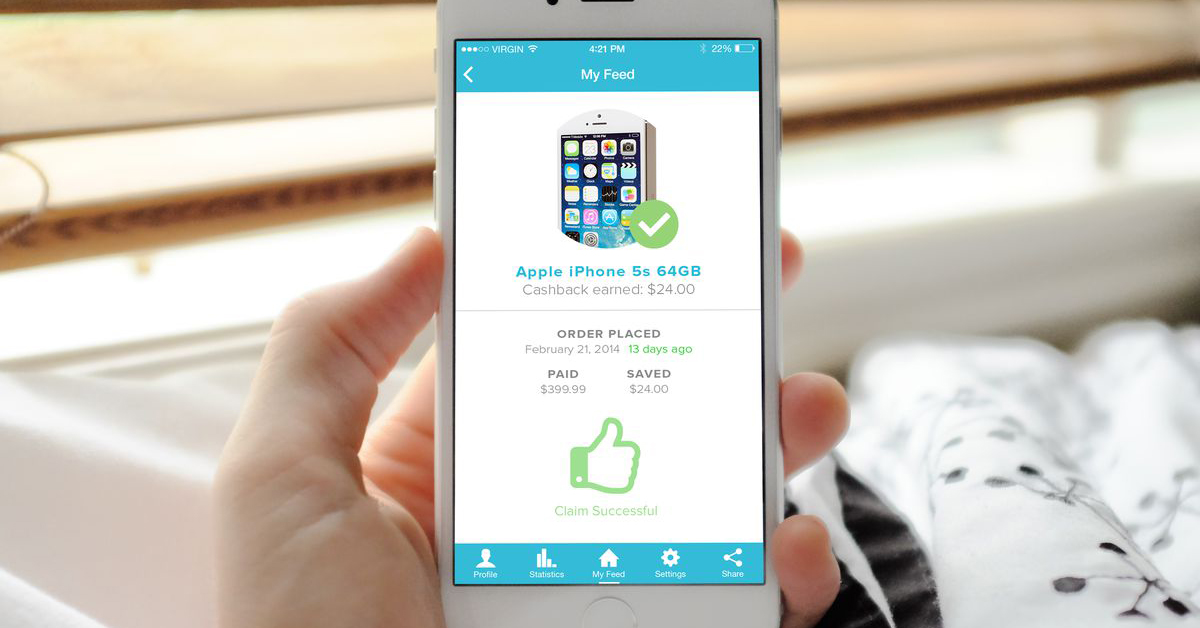

10. Get Money Back Instantly For Stuff You’ve Already Bought

Do you love getting refunds? How cool would it be to get money back on stuff you’ve already bought without having to do a thing? Paribus is an app that lets you find out if stores you’ve shopped at online owe you a refund. It’s free to sign up. Paribus connects to your email account and checks your receipts. If they find out a retailer has dropped their price they file a price adjustment claim for you automatically. Try out Paribus.

Paribus works with a huge number of merchants that you probably already shop at, including Walmart, Amazon, Costco, Best Buy, Target, Apple, Kohl’s, and more!

11. Never Pay For Home Repairs Again

Many homeowners don’t have the extra cash to shell out for repairs when something in the house breaks. You most likely have homeowners insurance right? But what about if your washing machine of 10 years breaks down? Or your dryer just stops working one day? Homeowner insurance won’t cover those repairs. That’s why getting setup with a Home Warranty Program can actually end up saving you a lot of money in the long run. It will cover any unexpected repairs to your appliances, plumbing, water heaters, heating and other electrical systems. They also will replace anything that they can’t fix. Make sure you shop around for rates on a home warranty program – this website will give you quotes that you can then choose from. A home warranty program should be a minor cost that can end up saving you major money.

12. Save On Health Care Costs With A Medicare Plan

Healthcare is an essential part of human life, and the costs of doctors and the right treatments add up more and more as we age. Right now we're seeing just how important it is to have your medical costs covered. Most retirees need to take some type of medication, so it’s only right that you should be getting the most out of your medical insurance.

By working with the best insurance company for your needs you can be sure to have the best coverage for the cheapest prices.

Some insurers will send seniors a discount card that you can show when paying for prescriptions. Just remember to check with your local pharmacy to see what discounts are available to you, because discounts might change depending on location.

Many seniors may be able to get extra benefits and don’t even know they’re available. You can also check if you are eligible to get vision, dental, hearing or prescription drug coverage included in your plan.

13. Wild Alaskan Company - Save $15 On Wild Caught Fish To Your Door

Going to the supermarket and searching for sustainably-harvested, wild-caught seafood isn't exactly the easiest thing to do right now. That's why thousands of people are now signing up with the Wild Alaskan Company. The Wild Alaskan Company was created to solve one of your biggest nutritional challenges: consistent access to premium, sustainable, wild-caught seafood. Wild Alaskan Company sources premium wild seafood from Alaska and the Pacific Northwest and they deliver it right to your door. Pick a plan and once a month you'll get a box of frozen seafood delivered right to your door. If you sign up today you can save $15 off your first box!

14. Install A Home Alarm System To Save On Home Insurance

This money saving idea is also for homeowners, so if you’re a renter you can skip this one. Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system isn’t just to stop burglars and intruders, it can also save you big money year after year. A house alarm will save you money on your homeowners insurance policy (which is generally mandatory if you own a home). In fact, on average installing a home alarm system will give homeowners a 10-20% discount on their insurance by having a high functioning home alarm system installed. The good news is that these home alarm companies are pretty desperate for customers at the moment so you can get a good deal. For instance, one of the best alarm system companies – ADT is currently offering over $800 in savings if you just pay the installation fee. That means you basically get a free alarm system for over a year, just by paying a $99 fee.

15. Get A Personal Loan (From $100 to $35,000)

Many homeowners might find that they are unexpectedly in a tough financial spot and need a little bit of help. That’s where personal loans can help. Personal loans can be used for almost any expense – from paying off credit cards to financing home repairs. They are typically paid back in monthly or bi-monthly installments over an extended period of time. Personal loans can be a convenient alternative to bank loans or high-interest credit cards, with online applications and no-hassle automated repayment. With PickALender you get access to loans for whatever you need and get to see the terms upfront before any commitment. Make sure you look at the interest rates offered and the loan repayment terms before going ahead with anything though.

16. Homeowners Can Save Up To $48,000 On Their Mortgages

One of the many perks of being a senior citizen is access to benefits that are otherwise unavailable to your younger peers. Unknown to many seniors are some of the amazing government refinance programs available to them.

Currently, Congress' mortgage relief program can lower senior homeowner payments by as much as $3,252 per year!

The bad news? This program is very temporary, as the banks want it eliminated as soon as possible. The good news is that once you qualify, you're in for good. There's nothing anyone at any bank can do to affect your savings. This program can expire anytime in 2020, so you must act now and see if you qualify for one of these life-changing refinance programs before it's too late.

URGENT: So many senior homeowners could still benefit today, but sadly, many perceive this Congress mortgage program as too good to be true. Remember, it's a free program and there's absolutely NO COST to see if you qualify. See if you qualify now before it's gone...

17. Stop Overpaying For Wines - Get 15 Bottles of Overstocked Wines

If you ever wanted to explore new wines from around the world and pay a fraction of the retail price, then Splash Wines is for you! Staying at home can be boring... Staying at home with a bunch of new wines to try out, that's called Winning.

Splash Wines curates some of the highest quality wines and provides them to you at steep discounts. For instance, many customers are receiving bottles of wine that usually cost between $20-$30 for only $6.99 per bottle. How do they offer such low prices? Since Splash doesn’t have retail stores, they are able to bypass the middle-man, like importers and distributors, and then they pass the savings on to their customers.

18. FIXD – Never Get Ripped Off On Auto Repairs & Save Thousands!

Have you ever seen the check engine light and simply ignored it? Have you ever thought about why you ignored it? Well, I know for me I would do just about anything to avoid going into an auto repair garage. I know they are going to try an up-charge me for repairs I don’t need, I’ll have to shell out $150 an hour for “labor” and worst of all, they might not even fix the problem. What follows ignoring the check engine light is a severely damaged car and thousands of dollars of repairs.

Seniors, unfortunately, fall victim to these mechanic scams more often than not. Mechanics view our senior citizens as the ultimate prey. Well FIXD is turning the tables, and mechanics hate it.

FIXD, a brilliant car gadget invented by a group of MIT grads, eliminates this whole process by immediately and simply diagnosing what’s wrong with your car. If you’re low on radiator fluid but your mechanic tells you that you’re transmission is out- you know he is lying.

Unfortunately, occurrences like these are quite common in the auto industry. Especially with seniors. With FIXD, you will never have to trust a mechanic again. FIXD puts the mechanic in your pocket and saves you thousands

19. Learn How To Make Money Flipping Stocks (This One Is Risky)

I know what you're thinking, the markets are crashing, why would anyone think of making money with stocks? Actually this might just be the perfect time for you to learn how to daytrade. Think about it, you're at home all day and can watch the indices like a hawk. Of course, this could be very risky as you can also lose money. That's where the Power Profit Trades comes in. You can watch their video to follow their trading strategy here.